A Nordic high yield specialist

Risk information: Historical returns are no guarantee of future returns. The money invested can both increase and decrease in value, and there is no certainty that you will get back the entire amount invested. Contact us for more information.

Focus on Innovative Sector Leaders

The Nordic high yield market is well-suited for active management. The market is only partially transparent, and significant opportunities arise from time to time. Identifying innovative sector leaders, combined with a strict risk management approach, is our strategy for delivering strong and stable results over time. We are convinced that leading returns are built on a solid sustainability analysis.

Stefan is Principal Portfolio Manager of the Vinga Corporate Bond fund and has been in the financial industry since 1997. Stefan has managed corporate bonds for over 20 years. He has served as a credit manager and head of interest rates at Storebrand Kapitalförvaltning in Oslo. Stefan holds a Ph.D. in Financial Economics from the School of Business, Economics, and Law at the University of Gothenburg and lectures in credit analysis at the Norwegian School of Economics.

Fund Management

VINGA CORPORATE BOND

The vision is to create the leading Nordic high yield fund, with a strategy of promoting sustainability and selecting innovative sector leaders. The fund primarily invests in bonds by Nordic issuers and is aimed at investors with a horizon of 2-3 years.

- Identifying innovative sector leaders with a positive credit rating trend

- Experienced management team with a strong historical performance

- An actively managed fund

- Risk-aware with an integrated ESG risk process (Article 8)

Discretionary Management

CUSTOMIZED PORTFOLIOS

The offering includes management of low-risk portfolios for companies that wish to optimize their cash management, as well as sector-specific high yield portfolios for clients with higher risk tolerance.

ACTIVE TREND

Vinga Active Trend invests in global bond, equity, and commodity markets using funds and exchange-traded funds. The investment strategy is to invest in megatrends and take advantage of favorable market opportunities.

Legal info

The asset management is carried out as a discretionary mandate by SIP Nordic Fondkommission AB, a Swedish securities company subject to authorisation and supervision by the Swedish Financial Supervisory Authority. The Principal Portfolio Manager is Stefan Westfeldt.

The above information refers to the Vinga Corporate Bond fund

Portfolio Strategy

Our portfolio strategy is based on our view of the global markets from the joint perspectives of a high yield asset manager and a macro analyst. We assemble our investment portfolio based on where we are in the credit-equity cycle, the economic and inflation cycle, as well as our view on which mega-sectors will dominate the markets in the coming periods. We combine fundamental and technical analysis to find entry and exit levels in the market.

Högräntepodden

(The high yield Podcast)

The podcast (in Swedish) focuses on the Nordic high yield market, but we also enjoy branching out into discussions about economic trends, macroeconomics, and much more. You can find it wherever podcasts are available.

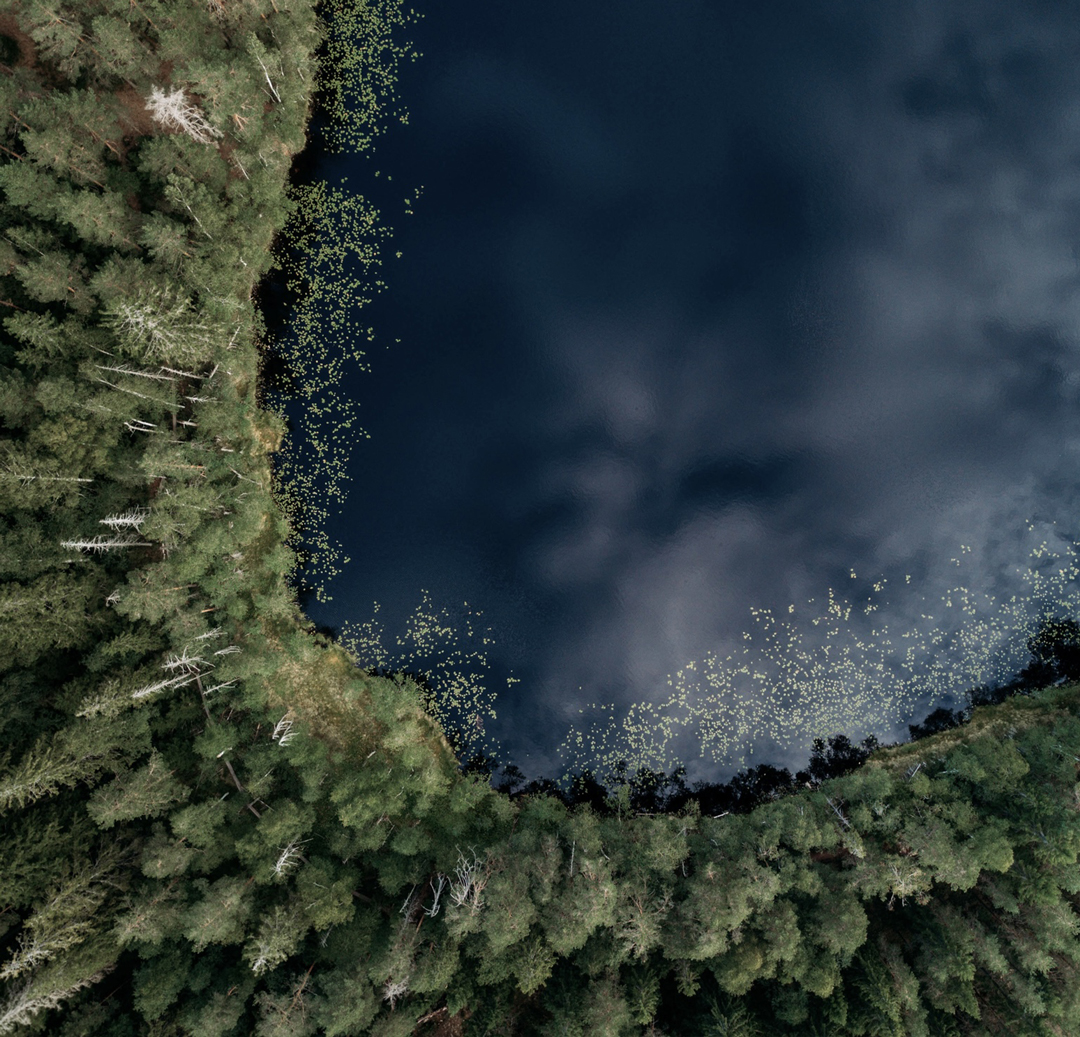

Sustainability

We believe that leading returns go hand in hand with a strong focus on environmental and social factors. Responsible ESG efforts contribute to enhanced risk management, sustainable value creation, and improved access to capital. This work also helps create a better society for all of us.

As part of our sustainability efforts, Vinga Asset Management collaborates with SustainAX, which provides leading ESG analyses of approximately 200 small and medium-sized Nordic companies. The company is independent, and all analysts are certified. The analyses delve deeply into environmental and social sustainability factors, also considering negative consequences.

Newsletter

Stay updated with our newsletter.